“Recycling leads with 98.22% median value”

A) Data:

I analysed waste management for BSE 30 companies based on the BRSR data they had filed with the regulator in form of XML/XBRI files. The data is for FY 23 and FY 22.

B) Introduction:

In an era where sustainability is no longer a choice but a necessity, understanding how companies manage their waste has become crucial. This post delves into the waste management practices of BSE 30 companies, based on the BRSR data they filed with the regulator for FY 23 and FY 22. We’ll explore the different types of waste generated, the proportions of each type, and how these companies are recycling, reusing, and recovering waste.

The PDF with visualisations is available in my LinkedIn post.

And my earlier blog post on waste management for the last year.

C) Part I Waste Management

The data is presented under following heads. Total Waste generated (in metric tonnes)

Plastic Waste (A)

It was a small percentage for almost all companies.

E-waste (B)

This component of the total was hundred percent for following companies. IndusInd Bank, Bajaj finance, Bajaj Finserv, HDFC bank. It was close to hundred percent for Axis bank.

Bio-medical waste (C)

It was almost 0 for all the companies.

Construction and demolition waste (D)

It looks like this activity had picked up during the year FY 23. It was close to hundred percent for Tata Consultancy Services. It was more than 50% for L&T, Infosys and NTPC.

Battery waste (E)

Tech Mahindra, HCL Technologies and Bharati Airtel reported more than 30% for this category.

Radioactive waste (F)

Thankfully, it was zero for almost all companies. An IT company reported a very small percentage.

Other Hazardous waste. Please specify, if any. (G)

It was more than 50% for the two pharmaceutical companies.

Other Non-hazardous waste generated (H).

Please specify, if any. (Break-up by composition i.e., by materials relevant to the sector)

Other non-hazardous waste occupies big part of total waste generated for almost all companies. Its median value was 71.25%. Classifying as such under others doesn't give much information. Sustainability leaders and regulators should ponder over this point.

Total (A+B + C + D + E + F + G + H)

Let me explain with an example. In case of Wipro for year FY23, the total waste generated was 4.48K metric tonnes. 55% of it was other non-hazardous waste, 34.4% was construction and demolition waste, and the rest was made up of e waste, plastic waste, battery waste, biomedical waste, and other hazardous waste. and c) Wipro e-waste was 5.9% of its total waste, whereas that of Infosys was only 3.9% of its total waste.

Median value of total waste generated was 24,068.8 in metric tonnes. The highest for a company was 20.23 MMT.

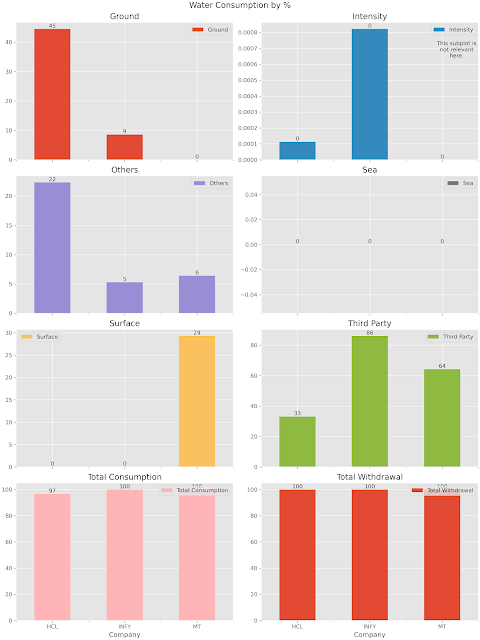

D) Part II Recycle, Reuse and Recover (RRR)

For each category of waste generated, total waste recovered through recycling, re-using or other recovery operations (in metric tonnes)

Three companies reported zero for the total waste recovered in FY23 & in FY22 (and no data on sub categories of recovery ) and similarly 2 companies in FY22. Is this the case of missing data?

(i) Recycled

Waste recycling appears to be preferred approach. Its median value in FY23 was 98.22% which is quite impressive.

These companies reported hundred percent recycling for both the years: L&T, Tata consultancy services, JSW steel Ltd, State Bank of India and Tata motors. This is really impressive.

(ii) Re-used

In FY23 more than 50% of companies reported 0% on reuse. While others had a very small number for reuse.

But two companies out for doing hundred percent re use mainly power grid Corporation of India and Titan company.

(iii) Other recovery operations

In FY23 more than 50% of companies did not opt for “other recovery, methods” for recovery which is good because “other method” wouldn’t give any information.

For each category of waste generated, total waste disposed by nature of disposal method (in metric tonnes) is reported as follows.

Four companies reported zero for total waste disposed (and no data on sub categories) in FY 23 and similarly, seven in FY 22.

(i) Incineration

Two companies reported hundred percent, and one came close to hundred percent in FY 23 under this category and one in FY 22.

Five companies reported more than 50% under this category for both the years.

(ii) Landfilling

Landfilling appears to be more preferred choice. 41.01% was the median value for it. It was 67.38% in FY22. 90 to 100% of waste (of the total waste disposed in FY23) was sent to landfill by eight companies, out of 30.

(iii) Other disposal operations

Six companies reported hundred percent under this category. Similarly, four FY 22.

As I said earlier, this doesn't clarify, what was the method.

Total

If I categorise the total waste generated into a) total recovered and b) total disposed, then I get the following analysis.

Median value of total waste recovered in FY23 in % was 71.81. This is a good number. The focus appears to be recovering of the waste.

The data was read using a Python script. Reading multiple machine readable XML files and gathering relevant specific data using a Python script helped.You can read the data across the companies. But you cannot compare it as there is no common base.

E) Conclusion

In conclusion, the analysis of BSE 30 companies’ waste management practices reveals a diverse landscape. While some companies have shown impressive strides in recycling and reusing waste, others have room for improvement. The high percentage of ‘Other Non-hazardous waste’ across companies calls for more transparency and specificity in waste categorization. Furthermore, the zero recovery reported by some companies raises questions about data completeness.

As we move forward, it’s clear that more consistent and detailed reporting, coupled with innovative waste management strategies, will be key to achieving our sustainability goals. Let’s hope that this analysis sparks conversations and actions towards better waste management in our corporate sector.