Indian Companies' SOx Emissions Increase : NTPC by 95.4%

Summary

SOX emissions of top BSE 30 Indian companies increased by 8.3% in FY 23 over FY 22 to 18,53,065 from 17,11,153 in Metric Tonnes. NTPC, the largest thermal electricity producer, accounted for 95.4% of the SOX emissions for year FY 23. Tata steel was the second largest emitter of SOX. JSW steel reported data that I couldn't use.

This is further to my blog post on analysis of NOx emissions.

Why Report on SOx Emissions?

Sulphur oxides (SOx), primarily in the form of sulphur dioxide (SO2), have significant impacts on both the environment and human health and hence listed companies report on SOx emissions in their sustainability reports.

SOx emissions contribute to climate change and harm the environment. Reporting these emissions is part of Environmental, Social, and Governance (ESG) disclosure. It helps identify deficiencies or weaknesses in a company’s internal controls and is crucial for transparency and integrity in reporting processes.

SOX emissions of BSE 30 companies in India

I downloaded data of these companies from their business responsibility and sustainability report reporting (BRSE) in form of XML files.

The data

The downloaded data in HTML table format looks like this. To it I added a column in the end named change PC showing the change in FY23 over FY22 in %.

The first impression of the data

- The data was reported in different units.

- Following companies didn't report the data.

- The following two companies provided data as a text comment.

The following 10 companies reported data as zero ['State Bank of India', 'HCL Technologies ', 'Power Grid Corporation of India ', 'Axis Bank ', 'Kotak Mahindra Bank ', 'IndusInd Bank ', 'Bajaj Finserv ', 'Bajaj Finance ', 'Tata Consultancy Services ', 'HDFC Bank ']

['Maruti Suzuki India ', 'ICICI Bank ']

- The maximum increase in value in % was 52.27 (associated with Mahindra & Mahindra).

- The maximum decrease in change value in % was -90.20 (associated with Tech Mahindra).

- Top 3 companies with maximum increase were:

- Mahindra & Mahindra : 52.27- Larsen & Toubro : 50.00- UltraTech Cement : 34.36

These are increases and hence are not good values.

- Top 3 companies with maximum decrease were:

- Infosys : -56.12- Tata Motors : -68.67- Tech Mahindra : -90.20

These are reductions and hence are good values.

Normalised data

I normalised the data in metric tonnes. The calculation is shown below.

For the conversion factors, I used standard metric conversions. Here are the sources for each conversion:

- Metric Tonnes, Tonnes, Metric Tonne, MT: These are already in Metric Tonnes, so no conversion is needed.

- mg/m3 to Metric Tonnes: 1 mg = 1e-6 kg, 1 m3 = 1e-3 m3 (assuming standard temperature and pressure), so 1 mg/m3 = 1e-9 Metric Tonnes.

- kg/tcs to Metric Tonnes: 1 kg = 1e-3 Metric Tonnes, so 1 kg/tcs = 1e-3 Metric Tonnes/tcs.

- Kg/day to Metric Tonnes/year: 1 Kg/day = 365 Kg/year = 365e-3 Metric Tonnes/year.

- μg/m³ to Metric Tonnes: 1 μg = 1e-9 kg, 1 m3 = 1e-3 m3 (assuming standard temperature and pressure), so 1 μg/m³ = 1e-12 Metric Tonnes.

- tons to Metric Tonnes: 1 ton (US ton) = 0.907185 Metric Tonnes, so 1 ton = 0.907185 Metric Tonnes.

- tCO2e to Metric Tonnes: 1 tCO2e = 1 Metric Tonnes (by definition of tCO2e).

- SO2 (g) to Metric Tonnes: 1 g = 1e-6 Metric Tonnes, so 1 SO2 (g) = 1e-6 Metric Tonnes.

- Metric tonnes to Metric Tonnes: These are the same, so no conversion is needed.

- Kg to Metric Tonnes: 1 Kg = 1e-3 Metric Tonnes, so 1 Kg = 1e-3 Metric Tonnes.

- Kilotonnes/year to Metric Tonnes: 1 Kilotonne/year = 1e3 Metric Tonnes/year, so 1 Kilotonne/year = 1e3 Metric Tonnes/year.

- mg/Nm3 to Metric Tonnes: 1 mg = 1e-6 kg, 1 Nm3 = 1 m3 (assuming standard temperature and pressure), so 1 mg/Nm3 = 1e-9 Metric Tonnes.

Please note that these conversions assume standard temperature and pressure and may not be accurate for all situations. Also, the conversion from Kg/day to Metric Tonnes/year assumes 365 days in a year, which may not be accurate for leap years. You may need to adjust these conversion factors based on your specific needs.

While it was an effort to normalise the data, it was worth it. Now you can compare values. Please note in the calculation JSW steel was omitted. The reason was the denominator had a unit which is about units of steel production. In the context of emissions and industrial processes, "tcs" in "kg/tcs" typically stands for "tonnes of crude steel". This unit is often used in the steel industry to measure emissions per tonne of steel produced. So, "kg/tcs" would mean "kilograms per tonne of crude steel". This allows for a standardized measurement of emissions that accounts for the scale of production. Please note that the exact meaning can vary depending on the specific context and industry. It's always a good idea to refer to the original source or context for the most accurate interpretation.I couldn't convert it into million tonnes as I have done with others, so the total SOx would be higher.

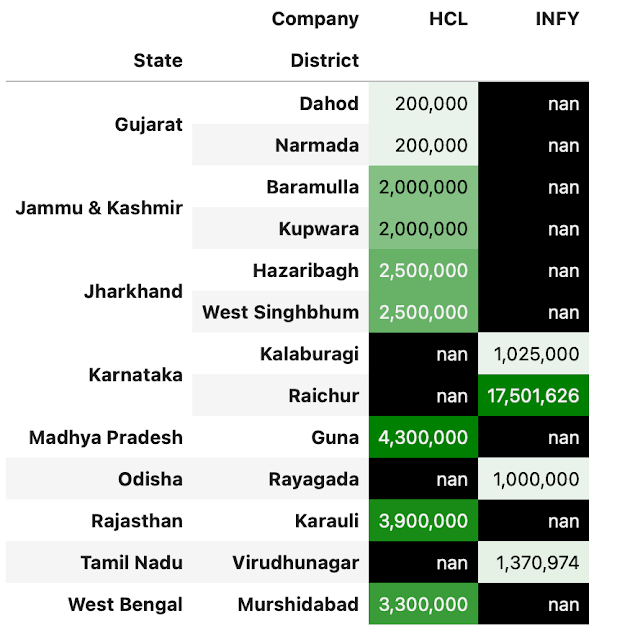

The normalised data table

All the units are in Metric Tonnes

The conclusion

While this data set offers some insights, drawing definitive conclusions was challenging due to missing information, inconsistencies in how (units) data was reported, and instances of unusable data. A more comprehensive and standardized data collection and reporting effort is recommended.